It’s no secret that buying a house is an expensive undertaking. While interest rates have recently increased, there’s actually something you can do to ensure your mortgage payments are more manageable. By paying more money upfront, you can lock in a lower interest rate on your mortgage.

What is a rate buydown?

Buydowns are easy to understand if you think of them as a mortgage payment subsidy.

Buydown funds can subsidize the loan payments during the first years of the mortgage, resulting in a temporary lower monthly payment, or reduce the interest rate for the life of the loan. This lower payment may allow you to qualify more easily for your mortgage.

The costs associated with the buydown are negotiated with the lender and often paid at the time of closing.

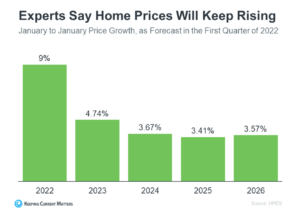

Because mortgage rates may continue to rise in 2022, the buydown method can be a useful tactic to offset rate hikes.

Buyers

Home buyers can pay upfront fees to the lender to obtain a lower interest rate for the first few years of the loan, or the entire loan term, depending on the buydown structure.

Sellers

Sellers can also pay to buy down a buyer’s interest rate as an incentive to purchase their home. A seller concession is negotiated in the contract for the amount of funds needed to accomplish the buydown on behalf of the buyer.

Builders

Like sellers, builders may also offer to pay the costs to buy down the buyers’ interest rate. Builders offer these incentives to entice buyers to purchase properties in their newly built communities.

Is a buydown right for you?

Whether it makes sense to choose a buydown when buying a home can depend on several factors:

• The interest rate for which you qualify

• The amount you could save in interest over the loan term

• Your estimated future income

• How long you plan to remain in the home.

Buydowns require paying more money upfront so you can save money in the long run. Therefore, buydowns are more beneficial if you intend to own the home for an extended period of time.

Not every mortgage is eligible for a buydown. For example, you can’t use a buy-down to purchase an investment property or for a cash-out refinance.

Let’s talk about how an interest rate buydown could help you purchase your next home!

Sources: investopedia.com, rocketmortgage.com & dailynews.com