While inflation, interest rates and talk of a global recession have real estate markets in flux, there are also signs of market easing.

Affordability

Lawrence Yun, National Association of REALTORS® chief economist, recently testified on Capitol Hill concerning the current real estate market. Yun’s main points included:

• The inventory crunch will continue to chip away at affordability and sideline more buyers.

• Though growth in home prices is slowing, a nationwide decline is unlikely.

• While the potential for weaker sales may help increase housing inventory in some markets, it won’t be enough to ease affordability constraints.

Research commissioned by the National Association of REALTORS® indicates a national deficit of 6 million housing units. This decades-in-the-making phenomenon has helped sustain year over-year price growth for a record 124 consecutive months, according to NAR housing reports.

In his Capitol Hill comments, Yun said, “This affordability crunch is felt most acutely as we move down the income scale and by minority households… That is why housing supply must be addressed to moderate gains in home prices and rents.”

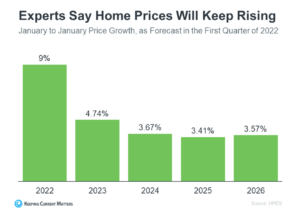

Home Prices

Higher mortgage rates and an increase in housing supply are factors that typically put downward pressure on home prices. But the market continues to be quite resilient, and costly In June, the national median listing price for single-family homes was $450,000, up 16.9% from the same time last year and more than 31% from

June 2020, according to Realtor.com.

With homes nearing half a million dollars, some buyers have stepped back from the market.

Mortgage applications dropped to the lowest level at the end of June, marking the biggest slump in 22 years, according to the Mortgage Bankers Association (MBA).

Despite some homes with higher list prices showing signs of extended time on the market, the overall lack of inventory is still leading to price gains. “Even after

reductions, prices are still higher compared to one year ago and much higher compared to before the pandemic,” Yun indicates.

Inflation And Interest Rates

Inflation eased slightly in July, which could bode well for the housing market in the months ahead, says Yun. Yun notes that interest rates, which had been consistently in the 4% to 5% range in the decade preceding COVID-19, hovered near record lows of around 3% throughout much of 2020 and 2021.

Consumer price inflation showed signs of deceleration in early summer.

Could the worst of sky-high inflation be behind Americans? Yun thinks so. By midsummer, gasoline prices began to decline, and there was more production of

apartments and single-family homes.

Yun predicts that consumer prices will pull back, encouraging the Federal Reserve policy to be less aggressive, resulting in lower mortgage rates.

The 10-year Treasury yield in mid-August stood at 2.7%. “That should translate into 30-year mortgage rates pulling back to under 5%,” Yun says. Some recent potential

home buyers who were pushed out of the market may then be able to qualify for a mortgage and a new home.

Inventory And Market Easing

There are bright spots in the market, such as gradually increasing inventory, which is good news for consumers.

Market trends point to a shift towards a more healthy market where both sellers and buyers have advantages.

Homebuyers are finding more selection and a little more time to make decisions. Sellers are adjusting to having their home on the market longer, and pricing their

home to align with the current market.

With so many variables affecting the current real estate market, let’s talk about how to accomplish your goals with your next home purchase or sale!

Sources: magazine.realtor, www.globeandmail.com, www.forbes.com