The pandemic is motivating more Millennials to feel like they’re finally ready to buy a home. But do they have the savings to do it?

Seventy-four percent of Millennials — ages 25 to 40 — recently surveyed say they are interested in purchasing a home in the next 12 months. However, 88% say they have significantly less savings than would be needed to buy a $300,000 home with a 20% down payment, or $60,000.

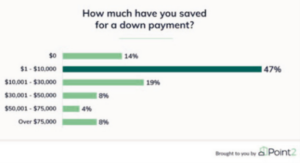

Fourteen percent of Millennials surveyed admit they have nothing saved for the purchase of a home.

Certainly, lower down payment programs exist. Whether these programs will be helpful for buyers whose savings are so limited is determined on a case by case basis. Down payments between 0% and 5% are possible with a home purchase, but these mortgage programs tend to cost more in the form of higher interest rates, and mortgage insurance premiums.

Forty percent of the Millennials surveyed say they set aside 10% or less of their income for a down payment. What’s more, 40% of respondents believe that $10,000 or less is enough to buy a home.

Seventy-six percent of Millennials in the study are looking for a detached home rather than a condo or townhome. Nineteen percent have their eye set on a home with more than 2,000 square feet, while 53% feel a home with 1001 – 2000 square feet will fit their needs.

If Millennial buyers are considering a down payment of 0%-5%, they may have a challenge finding homes for sale that are spacious enough to meet their demands with the amount of funds they have saved.

Those Millennials who hope to buy a home of their own may be able to save more as they move back in with their families. Young adults especially have moved in with family members as a result of the pandemic.

Call me for more information about opportunities to buy a home with a low down payment!

Source: Point2.com